Business Insurance in and around Carrollton

Searching for coverage for your business? Look no further than State Farm agent Tony Brewer!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Do you own a pet groomer, a HVAC company or an ice cream shop? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on your next steps.

Searching for coverage for your business? Look no further than State Farm agent Tony Brewer!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Every small business is unique and faces a wide array of challenges. Whether you are growing a beauty salon or a pizza parlor, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Tony Brewer can help with a surety or fidelity bond as well as employment practices liability insurance.

The right coverages can help keep your business safe. Consider contacting State Farm agent Tony Brewer's office today to review your options and get started!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

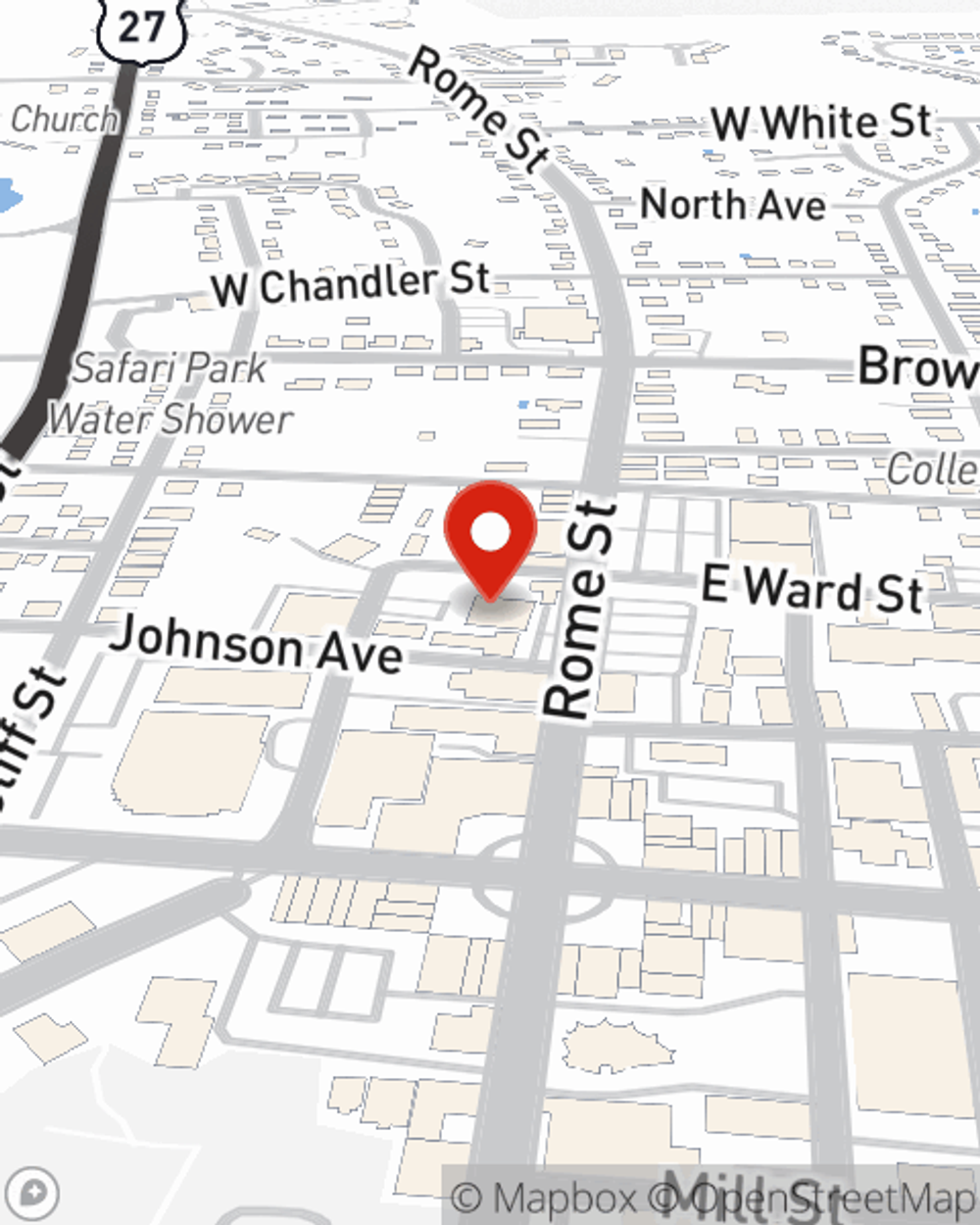

Tony Brewer

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.